Robinhood Markets Inc. is on course to generate $100 million revenue from transaction charges alone this year, while Zerodha Broking Ltd. does zero. That may seem like an opportunity lost, but it shows how evolved India’s fintech ecosystem is, as compared to the US—thanks to UPI.

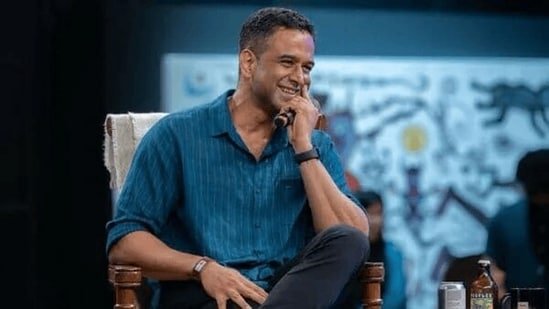

“I’m still shocked that people pay 1.75% on an instant withdrawal transaction. This really shows how broken the US banking system is,” Zerodha’s co-founder and CEO Nithin Kamath wrote on X. “Even in 2025, there’s still no full-fledged instant payments system like UPI—most fund transfers take a couple of days!”

“For comparison, we don’t charge @zerodhaonline clients for deposits (thanks to UPI) or instant withdrawals. We’ve processed over ₹50,000 crores in instant withdrawals in <2 years, at zero cost.”

Still, the idea of non-core revenue is nothing to be scoffed at.

“As an Indian startup with some scale, founders dream of generating revenue like this from non-core products,” Kamath went on to say. “Hence the rush to introduce everything: loans, insurance, payments and other financial services.”

“But nothing really works outside the core offering. It just shows how far India is compared to the US when it comes to customers willing to pay for add-ons.”