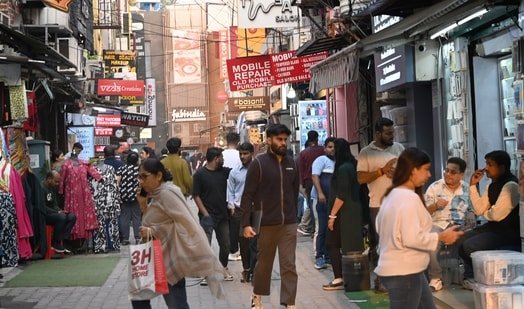

Delhi’s Khan Market slipped one spot in global rankings this year, from 23rd to 24th, but retained its position as India’s most expensive high-street retail location, with rents rising 3% year-on-year to around ₹22,000 per sq ft per year ($223 per sq ft), according to Cushman & Wakefield’s flagship retail report, Main Streets Across the World.

Experts noted that at the micro level, transactions can vary significantly. Some deals in prime stretches of Khan Market cross ₹2,200 per sq ft per month, depending on factors such as the exact store location, frontage, and which side of the market the unit is on.

London’s New Bond Street becomes the world’s most expensive retail destination, overtaking Milan’s Via Montenapoleone and New York’s Upper Fifth Avenue. As many as 58% of tracked retail streets saw rent increases, reflecting demand for space far exceeding availability, the report noted.

Cushman & Wakefield’s report Main Streets Across the World showed that rental growth in Asia Pacific slowed from 2.8% in 2024 to 2.1% in 2025, though performance varied widely across markets.

India’s Tier 1 cities led the rental growth in the Asia Pacific region, with Gurugram’s Galleria Market, ranked 26th, with a 25% jump in rents, followed by Connaught Place, also at 26th (+14%), and Mumbai’s Kemps Corner at 34th (+10%).

Also Read: Khan Market ranks as 22nd most expensive high street globally: report

This growth was driven by limited supply and strong demand, underlining the enduring appeal of prime retail locations in India’s key urban hubs and broader trend of premiumisation. Across 16 tracked Indian locations, rental growth averaged 6% year-on-year, the report noted.

At the other end of the spectrum, APAC’s most affordable main street is also in India- Anna Nagar 2nd Avenue in Chennai, where rents remain at $25 psf/yr.

London’s New Bond Street is world’s most expensive retail destination

London’s New Bond Street, meanwhile, has been crowned the world’s most expensive retail destination for the first time, where rents have risen by 22% in the past year to $2,231 per square foot per year (psf/yr). New Bond Street has leapfrogged Milan’s Via Montenapoleone ($2,179 psf/yr), which last year became the first European street to top the global rankings, and New York’s iconic Upper Fifth Avenue ($2,000 psf/yr), the rankings showed.

Cushman & Wakefield’s 35th edition of its flagship retail report, Main Streets Across the World, focuses on headline rents in best-in-class urban locations across the world, many of which are linked to the luxury sector, utilising Cushman & Wakefield’s proprietary data. The global index ranks the most expensive main street in each market.

Also Read: Delhi’s Connaught Place sees 14% increase in rent for retail spaces, Khan Market 7% in Jan-Mar: C&W

“India’s high streets are demonstrating exceptional resilience and growing global prominence. Premium destinations like Khan Market, Connaught Place, and Galleria Market are attracting international and domestic brands, driven by rising affluence and evolving consumer preferences. With limited mall supply, these high streets have become strategic hubs for retailers seeking visibility and engagement,” said Gautam Saraf, Executive Managing Director, Mumbai & New Business, Cushman & Wakefield.

“Year-to-date, high streets have accounted for over half of retail leasing activity, underscoring their critical role in shaping India’s retail evolution. This transformation reflects a broader trend of premiumisation and experiential retail, positioning India as one of Asia Pacific’s most dynamic markets,” he said.

Notably, India’s retail sector has outperformed both the global and APAC averages, registering a 6% YoY rental growth.

Globally, rents grew on average at 4.2% with 58% of markets experiencing rental growth. The Americas led regional rental growth at 7.9%, driven by currency effects in South America. Europe experienced steady 4% year-on-year (y-o-y) growth, with standout performances in Budapest and London. Meanwhile rents in Asia Pacific slowed to 2.1%, with strong growth in India and Japan offset by economic headwinds in Greater China and Southeast Asia, it showed.

Elsewhere in the region, Japan’s Ginza and Omotesando in Tokyo saw strong growth of 10% and 13% respectively, while rents in Hong Kong’s Tsim Sha Tsui declined by 6% to $1,515 psf/yr. Sydney’s Pitt Street Mall recorded modest growth of 4%, reaching $795 psf/yr, marking a return to positive momentum after years of stagnation, it said.

“Asia Pacific retail is demonstrating resilience despite economic challenges. India, Korea and Japan are leading growth with strong demand and premiumisation. Confidence is picking up in Singapore and Sydney, with rents inching higher. Vietnam and parts of Greater China remain a little soft due to geo-political and economic headwinds,” said Sona Aggarwal, Cushman & Wakefield’s Asia Pacific Head of Retail Sales & Strategy.