In 2025, smart savers are looking beyond traditional savings accounts. With inflation staying strong and market volatility becoming the norm, high-yield savings accounts (HYSAs) have become one of the safest and most rewarding places to park your cash.

If you’re wondering where to put your emergency fund, short-term savings, or just earn more on idle cash — you’re in the right place. In this article, we’ll explore the best high-yield savings accounts in 2025, compare interest rates, highlight features, and help you choose the right one based on your goals.

🔍 What Is a High-Yield Savings Account?

A high-yield savings account is a type of bank account that offers a significantly higher interest rate than a standard savings account — often 10x or more. These accounts are usually offered by online banks or fintech companies that have lower overhead costs, allowing them to pass on higher yields to customers.

In 2025, the average national savings rate is around 0.50% APY, while high-yield savings accounts offer anywhere from 4.00% to 5.50% APY — a big difference that adds up over time.

🏦 Best High-Yield Savings Accounts in 2025

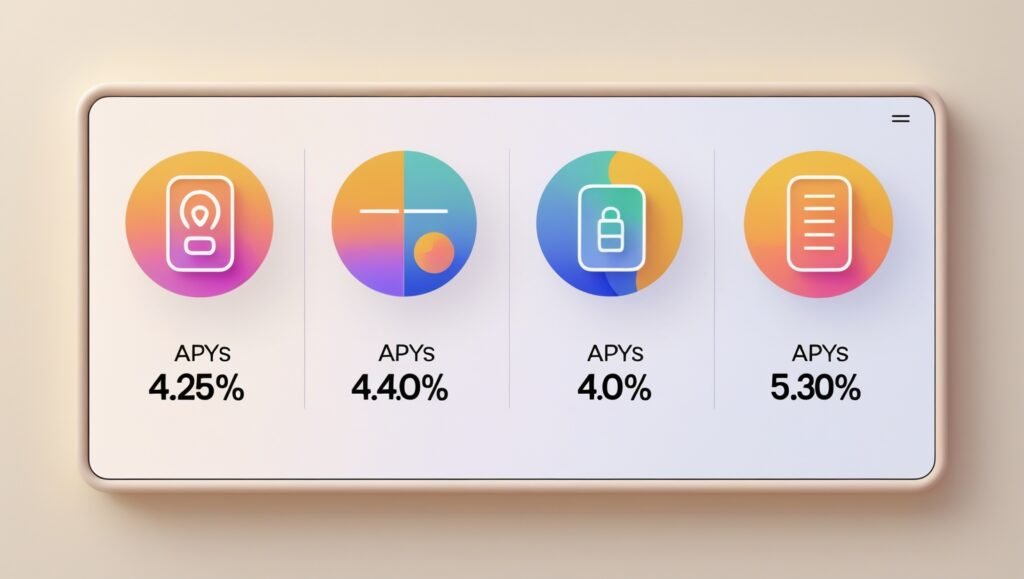

Here are some of the top-performing HYSAs this year based on APY, fees, ease of access, and customer reviews.

1. SoFi High-Yield Savings Account

APY: Up to 5.30%

Minimum Balance: $0

Monthly Fees: None

Key Features: No account fees, early direct deposit, automatic savings features

Why we like it: SoFi stands out for its well-rounded financial ecosystem — you get high interest, plus budgeting tools, investing options, and even career coaching. Great for digital-savvy users who want everything in one place.

2. Ally Bank Online Savings

APY: 4.35%

Minimum Balance: $0

Monthly Fees: None

Key Features: Buckets for goal-based savings, 24/7 customer support

Why we like it: Ally’s intuitive interface and budgeting “buckets” make it easy to organize your savings goals, whether you’re building an emergency fund or saving for a vacation.

3. Discover Online Savings Account

APY: 4.30%

Minimum Balance: $0

Monthly Fees: None

Key Features: Strong mobile app, fraud protection, 24/7 U.S.-based support

Why we like it: A great pick for those who value security and top-notch customer service, along with a competitive rate.

4. Marcus by Goldman Sachs

APY: 4.40%

Minimum Balance: $0

Monthly Fees: None

Key Features: No transaction limits, robust reputation

Why we like it: Backed by Goldman Sachs, Marcus offers stability, simplicity, and a straightforward online experience with no hidden fees.

5. American Express® High-Yield Savings

APY: 4.25%

Minimum Balance: $0

Monthly Fees: None

Key Features: Trusted brand, easy account management, strong online support

Why we like it: If you already use Amex credit cards, keeping your savings here can streamline your financial life while earning solid interest.

📝 Things to Consider When Choosing a High-Yield Savings Account

Before jumping into the highest APY, think about the following:

Fees: Make sure there are no hidden maintenance or withdrawal fees.

Minimum Requirements: Check if there’s a required opening deposit or minimum balance.

Accessibility: Do you need ATM access, or will online transfers work for you?

FDIC Insurance: Always ensure the bank is FDIC-insured for up to $250,000 per depositor.

📈 Why It Matters in 2025

In a world where every dollar counts, earning 4-5% APY instead of 0.5% can have a big impact. Whether you’re saving for a down payment, a trip, or just building a safety net, a high-yield savings account is a smart, low-risk way to grow your money faster — all while staying liquid and secure.

✅ Final Thoughts

High-yield savings accounts in 2025 are more competitive than ever. With APYs above 4%, no monthly fees, and digital convenience, there’s little reason to let your money sit in a low-interest account. Whether you choose SoFi, Ally, or Marcus, the key is to start saving now and let compound interest do its magic.

Remember: The best account is the one that fits your goals, your habits, and your financial lifestyle.

✅ Frequently Asked Questions (FAQ)

What is a high-yield savings account?

A high-yield savings account is a type of savings account that offers a much higher interest rate (APY) than traditional savings accounts, helping you grow your money faster.

Are high-yield savings accounts safe in 2025?

Yes. Most high-yield savings accounts are FDIC-insured (up to $250,000), making them a secure place to store your money while earning interest.

Can I access my money anytime in a high-yield savings account?

Generally, yes. You can transfer money in and out of your account via online banking, but some banks may limit the number of withdrawals per month.

Do I need a minimum deposit to open a high-yield savings account?

Most top high-yield savings accounts in 2025 have no minimum deposit requirements, but it’s always good to check each bank’s terms.

How often is interest paid on high-yield savings accounts?

Interest is usually compounded daily and paid monthly, helping your savings grow consistently over time.

Is online banking safe for high-yield savings accounts?

Yes. Reputable online banks use strong encryption, two-factor authentication, and fraud monitoring to keep your money and information safe.

Can I open multiple high-yield savings accounts?

Yes, you can open more than one high-yield savings account, especially if you want to separate your savings goals (like emergency fund, travel, etc.).