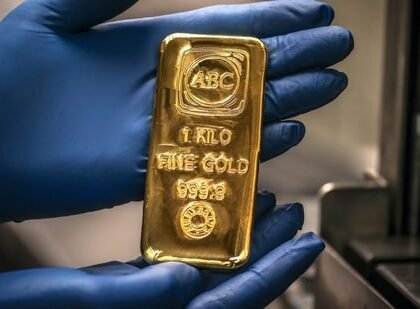

After scaling record highs, gold and silver prices saw a sharp pullback on Jan 30. Despite the correction, analysts believe both metals are likely to remain at elevated levels. In domestic markets, 24-carat gold slipped below the record highs touched earlier this week across major cities, while silver stayed below the ₹4 lakh per kilogram mark.

Here’s a look at how gold, silver and real estate compare as investments and which one may suit your financial goals best.

Entry points for gold, silver and real estate

When it comes to cost and investment size, these three asset classes differ significantly. Gold offers a relatively low entry point, allowing investors to buy in small quantities such as grams, coins, or digital gold, making it accessible even for first-time investors. Silver is cheaper per gram than gold, which makes it an affordable option for those looking to add precious metals to their portfolio in small amounts.

Real estate, by contrast, requires a high initial capital outlay, along with costs such as stamp duty, registration and ongoing maintenance, making it more suitable for investors with a long-term horizon. Understanding these differences can help investors allocate funds in line with their budget, risk appetite and investment goals.

What drives gold and silver prices?

Gold and silver are commodities largely driven by supply and demand dynamics. Silver’s demand is strongly supported by its industrial uses, while gold serves as a hedge during periods of global market uncertainty. Even in economic downturns, gold tends to retain value and is widely regarded as a reliable store of wealth.

How do returns of real estate, silver and gold differ?

Returns across real estate, silver and gold depend on timing, market conditions and asset selection. “In real estate, rental income and capital appreciation vary widely by location, while commodity returns fluctuate with demand and investor sentiment,” says Abhishek Kumar, a Securities and Exchange Board of India (Sebi)-registered investment advisor and founder and chief investment advisor at SahajMoney.

Branded or high-quality assets in any category tend to perform better. Overall, diversification across these asset classes, aligned with personal financial goals, remains key to a balanced investment strategy.

What should you invest in – gold, silver or real estate?

Gold, silver and real estate serve different investment purposes. Gold, in particular, acts as a safe haven during periods of geopolitical uncertainty and offers high liquidity, but investors should be cautious about chasing price highs.

Also Read: Joint tax filing for couples? ICAI’s Budget vision proposes reshaping home loan, rental tax math

“They should use dips to accumulate gold as an asset, or they can SIP in paper gold for the long term. holds. Investors must prioritise liquid, low-cost storage options like ETFs or digital gold over physical purchases,” says Madhupam Krishna, Securities and Exchange Board of India (Sebi) registered investment advisor (RIA) and chief planner, WealthWisher Financial Planner and Advisors.

Meanwhile, silver offers both investment and industrial appeal, making it more volatile than gold. “We believe that commodities (gold and silver) should certainly form a part of an investor’s portfolio, and its allocation should be around 10- 15% of the overall portfolio,” says Hardaman Singh Seth, Head Business – ETF, Mirae Asset Investment Managers (India).

Also Read: Budget 2026 real estate expectations: Will homebuyers get higher interest deduction and affordable housing threshold?

It is important to note that references to gold and silver here pertain to gold and silver ETFs as financial instruments, not physical holdings such as jewellery or ornaments.

In real estate, location remains critical and requires careful research; investors are advised to focus on areas offering sustainable returns rather than blindly chasing trends.

For real estate, the type of asset matters. “Conventional property investments can make sense depending on elevation, location, and other factors. For investment-driven purposes, instruments like REITs (Real Estate Investment Trusts) can provide exposure with a suggested allocation of around 10%,” adds Kumar.

Anagh Pal is a personal finance expert who writes on real estate, tax, insurance, mutual funds and other topics